GST 2.0: India’s New Two-Slab Structure Explained (Effective September 22, 2025)

Introduction – Why This GST Reform Matters

The Goods and Services Tax (GST) is India’s unified indirect tax system, replacing multiple state and central taxes to simplify compliance and boost economic efficiency.

On 3 September 2025, during the 56th GST Council meeting chaired by Finance Minister Nirmala Sitharaman, a landmark decision was made: India will move from a four-slab GST structure (5%, 12%, 18%, 28%) to two main slabs – 5% and 18% – plus a 40% rate for luxury and sin goods.

The changes will take effect from 22 September 2025, coinciding with the start of Navratri. This reform is expected to make everyday essentials cheaper, simplify compliance for businesses, and potentially boost consumer spending.

Key Highlights of the GST 2.0 Announcement

Two-slab GST structure: 5% & 18%, plus 40% for luxury/sin goods.

Nil GST on essential food items like milk, paneer, rotis, parathas, and 33 life-saving drugs.

Major rate cuts:

Small cars, bikes under 350cc, tractors, cement, auto parts → 18% (down from 28%).

Footwear up to ₹2,500 → 5% (earlier 12%).

TVs, ACs, geysers → 18% (earlier 28%).

Boost to EVs: 5% GST retained to encourage clean mobility.

Hospitality: Hotel rooms up to ₹7,500/night → 5% (earlier 12%).

Sector-Wise Impact Analysis

🚗 Automobile Industry

Winners: Small cars, entry-level bikes, tractors – now at 18% GST, making them more affordable.

EV push: Retaining 5% GST on electric vehicles supports India’s clean energy goals.

🛒 FMCG & Household Goods

Soaps, shampoos, namkeens, pasta, butter, and ghee now in the 5% slab, reducing household expenses.

🏨 Hospitality & Tourism

Mid-range hotels benefit from GST cut to 5% for rooms under ₹7,500/night.

Luxury hotels remain at 18%, keeping premium stays in the higher tax bracket.

👟 Footwear Industry

Footwear priced up to ₹2,500 now at 5% GST – expected to boost demand.

🏥 Healthcare

33 life-saving drugs, including cancer medicines, now GST-free.

🌱 Agriculture & Renewable Energy

Lower GST on bio-pesticides, solar heaters, and windmills encourages sustainable practices.

Economic & Consumer Impact

Inflation relief: Lower GST on essentials could ease price pressures.

Festive boost: Cheaper goods ahead of Navratri and Diwali may spur spending.

Revenue trade-off: States may face short-term revenue loss, estimated at ₹47,700 crore, but higher consumption could offset this over time.

Political & Industry Reactions

Finance Minister Nirmala Sitharaman: Called it a “reform for the common man” with a focus on affordability.

Industry leaders: Anand Mahindra welcomed the move but urged further reforms.

Opposition concerns: Some states worry about revenue loss and demand compensation.

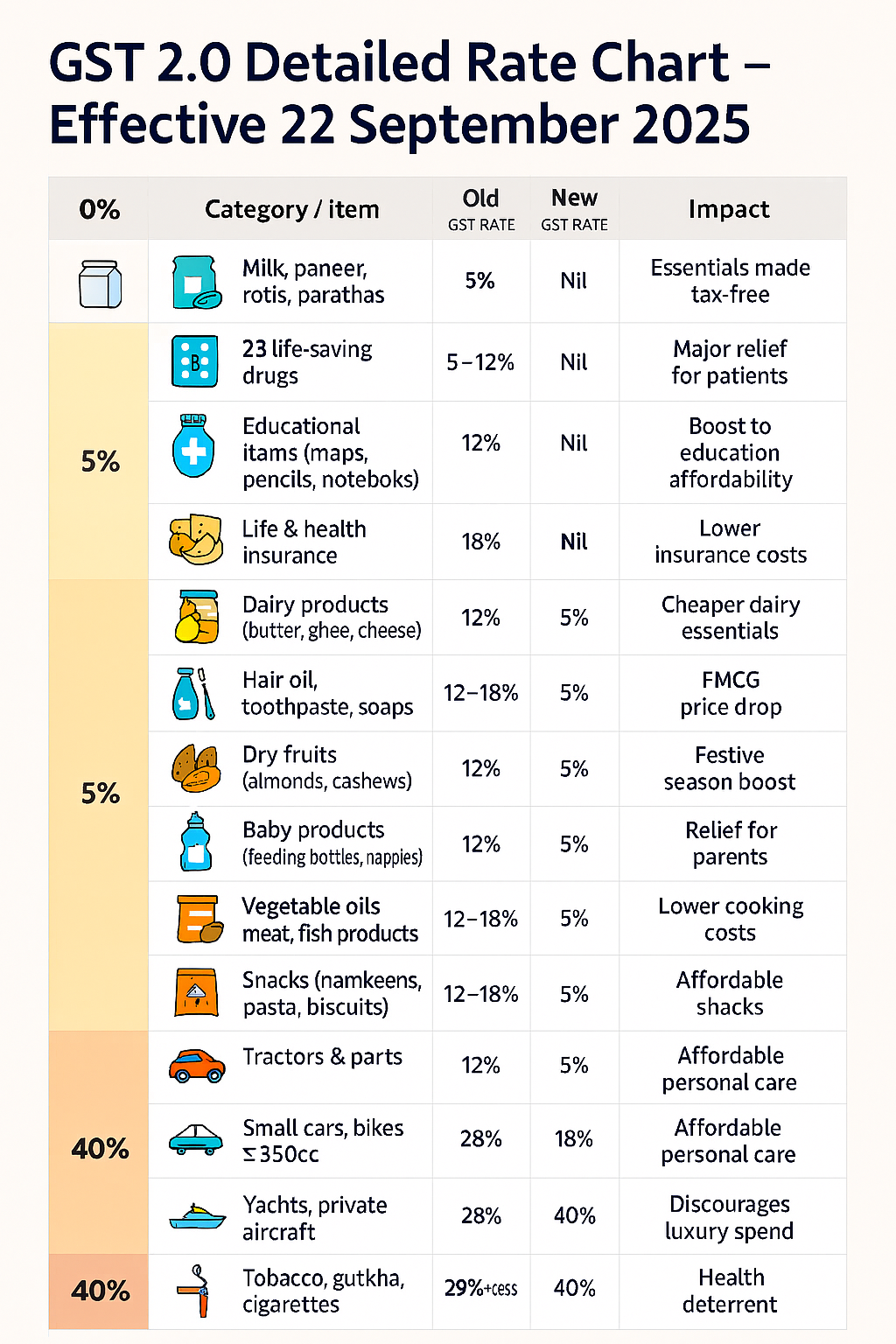

Complete GST Rate Change Table

| GST Slab | Icon | Category / Item | Old Rate | New Rate | Impact |

|---|---|---|---|---|---|

| 0% (Nil) | 🥛 | Milk, paneer, rotis, parathas | 5% | Nil | Essentials made tax-free |

| 💊 | 33 life-saving drugs | 5–12% | Nil | Major relief for patients | |

| 📚 | Educational items (maps, pencils, notebooks) | 12% | Nil | Boost to education affordability | |

| 🛡️ | Life & health insurance | 18% | Nil | Lower insurance costs | |

| 5% | 🧀 | Dairy products (butter, ghee, cheese) | 12% | 5% | Cheaper dairy essentials |

| 🪥 | Hair oil, toothpaste, soaps | 12–18% | 5% | FMCG price drop | |

| 🌰 | Dry fruits (almonds, cashews, dates) | 12% | 5% | Festive season boost | |

| 🍼 | Baby products (feeding bottles, nappies) | 12% | 5% | Relief for parents | |

| 🛢️ | Vegetable oils, meat/fish products | 12–18% | 5% | Lower cooking costs | |

| 🍪 | Snacks (namkeens, pasta, biscuits) | 12–18% | 5% | Affordable snacks | |

| 🌾 | Fertilisers, bio-pesticides | 12–18% | 5% | Support for farmers | |

| 🚜 | Tractors & parts | 12–18% | 5% | Agricultural cost reduction | |

| 🛏️ | Hotel rooms ≤ ₹7,500/night | 12% | 5% | Boost to tourism | |

| 💇 | Beauty & wellness services | 18% | 5% | Affordable personal care | |

| 18% | 🚗 | Small cars, bikes ≤ 350cc | 28% | 18% | Affordable mobility |

| 🧱 | Cement | 28% | 18% | Lower construction costs | |

| 📺 | TVs, ACs, geysers | 28% | 18% | Electronics more affordable | |

| ⚙️ | Auto parts, paints | 28% | 18% | Industrial cost relief | |

| 🛋️ | Consumer durables | 28% | 18% | Encourages purchases | |

| 40% | 🚙 | Luxury cars, SUVs, big bikes | 28% | 40% | Discourages luxury spend |

| 🛥️ | Yachts, private aircraft | 28% | 40% | High-end goods taxed more | |

| 🚬 | Tobacco, gutkha, cigarettes | 28%+cess | 40% | Health deterrent | |

| 🥤 | Sugary & aerated drinks | 28%+cess | 40% | Discourages sugary drinks |

How Businesses Should Prepare

Update billing software to reflect new GST rates.

Revise pricing strategies to stay competitive.

Communicate changes to customers to build trust.

Ensure compliance to avoid penalties.

Conclusion – A Turning Point for India’s Tax System

GST 2.0 is more than a rate cut – it’s a structural simplification aimed at boosting consumption, reducing compliance burden, and making essentials affordable. While states may face short-term revenue challenges, the long-term benefits could reshape India’s tax landscape.

Final thought: If implemented effectively, GST 2.0 could be the most consumer-friendly tax reform since GST’s launch in 2017.

Sources for Gathering Information

Financial Express – GST Rate Cut Reactions & Industry Impact