A tariff is a tax or customs duty placed on imported goods when they enter a country.

While it may sound like a dry economic term, tariffs play a big role in shaping international trade, business strategy, and even diplomatic relations.

Sometimes, governments raise or lower tariffs to protect local industries, encourage trade partnerships, or respond to foreign policies.

For example:

- In the U.S.–China trade tensions (2018–2019), both countries imposed higher tariffs on each other’s goods to gain bargaining power.

- The European Union imposed tariffs on certain U.S. steel imports to protect its domestic industry.

Simple example:

- Country A produces smartphones and sells them to Country B for ₹100 each.

- Country B has a 10% bound tariff on imported smartphones, meaning the final price in Country B will be ₹110.

- Meanwhile, a local smartphone maker in Country B still sells for ₹100, making it more competitive.

Direct effects of this tariff:

- Country B’s government earns ₹10 in revenue per imported phone.

- Local businesses get a competitive boost.

Indirect effects can be wider:

- Consumer prices and inflation may rise in Country B.

- Country A’s GDP could be affected if exports drop.

- Trade relations between the countries may improve—or worsen—depending on the context.

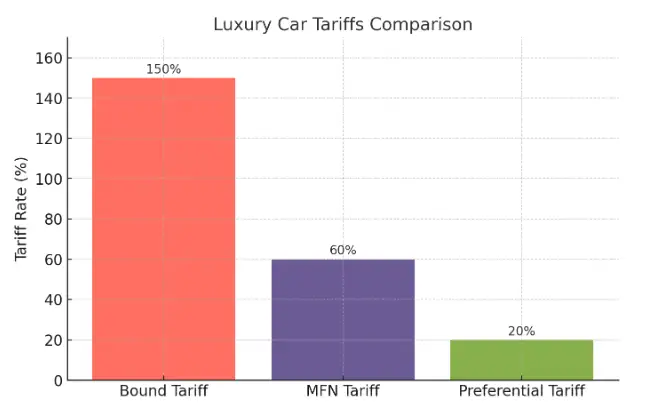

Types of Tariffs

- Bound Tariff

- The maximum tariff rate a WTO member country agrees not to exceed on a specific product line (explained in Glossary below).

- Must be applied equally to all WTO members unless a preferential agreement exists.

- If a country breaches its bound tariff, the affected exporter can file a complaint through WTO’s Dispute Settlement Body.

Example: India has a bound tariff of 40% on certain dairy products—meaning it cannot legally impose more than that rate on WTO members.

- Most-Favoured-Nation (MFN) Tariff

- The actual tariff applied to WTO members unless a preferential rate is applicable.

- Always equal to or lower than the bound rate.

Example: India’s bound tariff on passenger cars may be 60%, but its MFN applied rate could be 40%.

- Preferential Tariff

- A lower tariff (sometimes zero) applied to imports from countries with which there is a Preferential Trade Agreement (PTA) or Free Trade Agreement (FTA).

Example: Under the ASEAN-India FTA, tariffs on certain goods are reduced to 0–5%.

- A lower tariff (sometimes zero) applied to imports from countries with which there is a Preferential Trade Agreement (PTA) or Free Trade Agreement (FTA).

Purpose of Tariffs

Tariffs can serve multiple purposes, often overlapping:

- Protect Domestic Industries

- Helps local producers compete against cheaper imports.

Example: Tariffs on imported steel protect domestic steel mills from low-cost foreign steel.

- Helps local producers compete against cheaper imports.

- Generate Government Revenue

- Especially important for developing economies with limited tax collection infrastructure.

Example: Some African nations rely heavily on import duties as a revenue source.

- Especially important for developing economies with limited tax collection infrastructure.

- Political Leverage or Retaliation

- Used in trade disputes to pressure another country.

Example: China imposed tariffs on U.S. soybeans during the 2018–2019 trade tensions.

- Used in trade disputes to pressure another country.

Real Example: Refined Sugar (HS 1701) Imported into India

- Product: Refined Sugar

- Exporting Country: Any WTO member (example: Brazil)

- Importing Country: India

- HS Code: 1701 series (e.g., 1701.91 – sugar, refined, in solid form)

- Bound rate: 100%

- MFN rate: 40%

Conclusion & Series Hook

Tariffs are more than just a tax—they are powerful tools that influence prices, trade flows, and even diplomatic relations.

By understanding basic terms like bound rate, MFN, and preferential tariff, you can better interpret trade news and policies.

In the next blog, we’ll explore:

“How Tariffs Are Calculated and Collected” — including customs procedures, valuation methods, and real-world collection practices.

Glossary

- Product Line – A category of goods defined for tariff purposes under the Harmonized System (HS) code. Example: HS Code 8703 covers passenger cars.

- WTO – World Trade Organization, the global body regulating trade rules between countries.

- PTA / FTA – Preferential or Free Trade Agreement, where countries agree to reduce or eliminate tariffs for each other.

Citations

- World Trade Organization (WTO) | Tariffs Overview – https://www.wto.org/

- OECD | Glossary of Statistical Terms – https://stats.oecd.org/glossary/

- World Integrated Trade Solution (WITS) | Data on Export, Import, Tariff, NTM – https://wits.worldbank.org/

FAQs

1. What is a tariff in international trade?

A tariff is a tax or customs duty imposed on imported goods when they enter a country. It can affect product prices, trade flows, and business competition.

2. What are the main types of tariffs?

The main types are:

Bound Tariff: The Maximum rate a country agrees not to exceed under WTO rules.

Most-Favoured-Nation (MFN) Tariff: The standard rate applied to all WTO members unless a special agreement exists.

Preferential Tariff: Reduced rate for countries with a trade agreement.

3. Why do governments impose tariffs?

Governments impose tariffs to protect domestic industries, generate revenue, or use them as leverage in trade negotiations or disputes.

4. How do tariffs impact consumers?

Tariffs can increase the prices of imported goods, potentially leading to higher inflation. Consumers may pay more, but local industries might benefit.

5. Can tariffs influence diplomatic relations?

Yes. Tariffs are sometimes used as political tools—either to encourage cooperation or as retaliation during trade disputes, affecting international relationships.